The London Central Portfolio has carried out research into the property market in London. Over the past two years there has been a subdued level of price growth, with buyers adapting to the continuous changes to the residential tax regime as well as political and economic uncertainty that has been cause by Brexit and two General Elections taking place in quick succession.

The residential market in Prime Central London has seen an upturn during this year’s second quarter. The Land Registry data has shown that average house prices have reached £1.9 million after experiencing a quarterly growth of 5.8%. This growth has also been boosted by a small number of high value sales. However, this research has also shown that the number of transaction have stayed at very low levels. The Land Registry have noted that there have been 3,750 sales over the course of the last 12 months. This means that the price of the sales has led to the data demonstrating growth as opposed to an increase in the number of sales taking place.

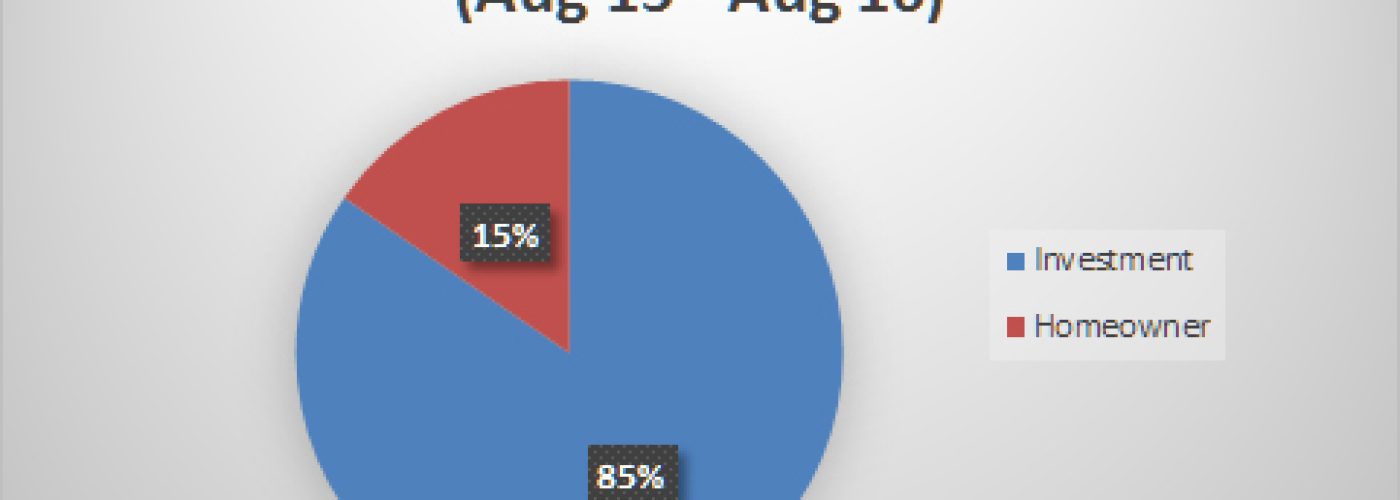

The research carried out by the London Central Portfolio, or LAP has shown that homebuyers appear to be more attracted to luxury properties that have been discounted, with 45% of purchases taking place in Prime Central London in this category. There has also been an increase in the number of luxury sales, with more properties being sold in the £5 – £10 million bracket. Activity has been significantly slower in the £1 million an under price category, with the sector seeing a 9.4% decrease and the majority of the purchases carried out by buy to let investors.

Investors have demonstrated a wait and see plan of action, whereas buyers are looking more and more for trophy heritage property when possible that has been priced higher than their budget in the past.